September 6, 2023

IRS: South Carolina taxpayers impacted by Idalia qualify for tax relief; Oct. 16 deadline, other dates postponed to Feb. 15

WASHINGTON — The Internal Revenue Service today announced tax relief for individuals and businesses affected by Idalia, anywhere in South Carolina. These taxpayers now have until Feb. 15, 2024, to file various federal individual and business tax returns and make tax payments. This is similar to relief already being provided in most of Florida.

The IRS is offering relief to any area designated by the Federal Emergency Management Agency (FEMA). All 46 counties in South Carolina qualify. Individuals and households that reside or have a business in these counties qualify for tax relief. The current list of eligible localities is always available on the disaster relief page on IRS.gov.

Filing and Payment Relief

The tax relief postpones various tax filing and payment deadlines that occurred from Aug. 29, 2023, through Feb. 15, 2024 (postponement period). As a result, affected individuals and businesses will have until Feb. 15, 2024, to file returns and pay any taxes that were originally due during this period.

This means, for example, that the Feb. 15, 2024, deadline will now apply to:

- Individuals who had a valid extension to file their 2022 return due to run out on Oct. 16, 2023. The IRS noted, however, that because tax payments related to these 2022 returns were due on April 18, 2023, those payments are not eligible for this relief.

- Quarterly estimated income tax payments normally due on Sept. 15, 2023, and Jan. 16, 2024.

- Quarterly payroll and excise tax returns normally due on Oct. 31, 2023, and Jan. 31, 2024.

- Calendar-year partnerships and S corporations whose 2022 extensions run out on Sept. 15, 2023.

- Calendar-year corporations whose 2022 extensions run out on Oct. 16, 2023.

- Calendar-year tax-exempt organizations whose extensions run out on Nov. 15, 2023.

In addition, penalties for the failure to make payroll and excise tax deposits due on or after Aug. 29, 2023, and before Sept. 13, 2023, will be abated as long as the deposits are made by Sept. 13, 2023.

The IRS disaster relief page has details on other returns, payments and tax-related actions qualifying for relief during the postponement period.

The IRS automatically provides filing and penalty relief to any taxpayer with an IRS address of record located in the disaster area. These taxpayers do not need to contact the agency to get this relief.

It is possible an affected taxpayer may not have an IRS address of record located in the disaster area, for example, because they moved to the disaster area after filing their return. In these kinds of unique circumstances, the affected taxpayer could receive a late filing or late payment penalty notice from the IRS for the postponement period. The taxpayer should call the number on the notice to have the penalty abated.

In addition, the IRS will work with any taxpayer who lives outside the disaster area but whose records necessary to meet a deadline occurring during the postponement period are located in the affected area. Taxpayers qualifying for relief who live outside the disaster area need to contact the IRS at 866-562-5227. This also includes workers assisting the relief activities who are affiliated with a recognized government or philanthropic organization.

Additional Tax Relief

Individuals and businesses in a federally declared disaster area who suffered uninsured or unreimbursed disaster-related losses can choose to claim them on either the return for the year the loss occurred (in this instance, the 2023 return normally filed next year), or the return for the prior year (2022). Taxpayers have extra time – up to six months after the due date of the taxpayer’s federal income tax return for the disaster year (without regard to any extension of time to file) – to make the election. Be sure to write the FEMA declaration number – DR-3597-EM − on any return claiming a loss. See Publication 547, Casualties, Disasters, and Thefts, for details.

Qualified disaster relief payments are generally excluded from gross income. In general, this means that affected taxpayers can exclude from their gross income amounts received from a government agency for reasonable and necessary personal, family, living or funeral expenses, as well as for the repair or rehabilitation of their home, or for the repair or replacement of its contents. See Publication 525, Taxable and Nontaxable Income, for details.

Additional relief may be available to affected taxpayers who participate in a retirement plan or individual retirement arrangement (IRA). For example, a taxpayer may be eligible to take a special disaster distribution that would not be subject to the additional 10% early distribution tax and allows the taxpayer to spread the income over three years. Taxpayers may also be eligible to make a hardship withdrawal. Each plan or IRA has specific rules and guidance for their participants to follow.

The IRS may provide additional disaster relief in the future.

The tax relief is part of a coordinated federal response to the damage caused by this storm and is based on local damage assessments by FEMA. For information on disaster recovery, visit disasterassistance.gov.

March 30, 2023

WASHINGTON – As part of the annual Dirty Dozen tax scams series, the Internal Revenue Service today renewed a warning about so-called Offer in Compromise “mills” that often mislead taxpayers into believing they can settle a tax debt for pennies on the dollar.

The IRS continues to see instances of heavily advertised promises offering to settle taxpayer debt at steep discounts. The IRS sees many situations where taxpayers don’t meet the technical requirements for an offer, but they had to face excessive fees from promoters for information they can easily obtain themselves.

Offer in Compromise mills highlight day nine of the Dirty Dozen series. Offers in Compromise are an important program to help people who can’t pay to settle their federal tax debts. But “mills” can aggressively promote Offers in Compromise in misleading ways to people who clearly don’t meet the qualifications, frequently costing taxpayers thousands of dollars.

A taxpayer can check their eligibility for free using the IRS’s Offer in Compromise Pre-Qualifier tool.

“Too often, we see some unscrupulous promoters mislead taxpayers into thinking they can magically get rid of a tax debt,” said IRS Commissioner Danny Werfel. “This is a legitimate IRS program, but there are specific requirements for people to qualify. People desperate for help can make a costly mistake if they clearly don’t qualify for the program. Before using an aggressive promoter, we encourage people to review readily available IRS resources to help resolve a tax debt on their own without facing hefty fees.”

The Dirty Dozen is an annual IRS list of 12 scams and schemes that put taxpayers and the tax professional community at risk of losing money, personal data and more. Some items on the list are new and some make a return visit. While the list is not a legal document or a formal listing of agency enforcement priorities, it is intended to alert taxpayers, businesses and tax preparers about scams at large.

Working together as the Security Summit, the IRS, state tax agencies and the nation’s tax industry have taken numerous steps to warn people about common scams and schemes during tax season and beyond. The Security Summit initiative is committed to protecting taxpayers, businesses and the tax system from scammers and identity thieves.

Watch to watch out for: Offer in Compromise mills

An Offer in Compromise (OIC) is when the taxpayer works with the IRS to settle a tax debt for less than the full amount owed. It is an option for those unable to pay the full tax liability or if doing so creates a financial hardship. The IRS takes in consideration each unique set of facts and circumstances. This agreement can happen directly between the taxpayer and the IRS without a third party.

An Offer in Compromise “mill” will usually make outlandish claims, frequently in radio and TV ads, about how they can settle a person’s tax debt for cheap. In reality, the promoter fees are often excessive, and taxpayers pay the OIC mill to get the same deal they could have received on their own by working directly with the IRS. This takes unnecessary money out of the taxpayer’s wallet.

In addition, not every taxpayer will qualify for an OIC. Some promoters knowingly advise indebted taxpayers to file an OIC application even though the promoters know the person will not qualify, costing honest taxpayers money and time.

The IRS urges people to take a few minutes to review information on IRS.gov to see if they might be a good candidate for the OIC program – and avoid costly promoters. As a first step, a taxpayer can check their OIC eligibility for free using the IRS’s Offer in Compromise Pre-Qualifier tool. And the IRS reminds taxpayers about the First Time Penalty Abatement policy, where taxpayers can go directly to the IRS for administrative relief from a penalty that would otherwise be added to their tax debt.

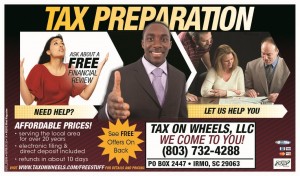

Tax On Wheels, LLC offers legitimate services to assist you with your IRS debt. Sometimes the best answer is to simply pay your bill, either in installments or with a single lump sum. However, you may fit into a category that will allow you some relief on your tax debts. Tax On Wheels, LLC can assist you with:

-

- Bringing you into compliance by preparing and filing all past due tax returns

- Determining if you have criminal exposure and will need to consult with a tax attorney

- Evaluating your tax debt and your personal financial situation to determine if you might be eligible for any of several tax debt relief tools available from the IRS

- Developing a strategy for using any of the legally available tools to minimize the amount of your tax debt you actually have to pay

- Preparing and submitting the necessary forms and requests to obtain the tax relief that you are entitled to under the law, up to and including possible total elimination of your tax debt.

- Providing ongoing monitoring and assistance in dealing with the IRS bureaucracy to insure your application is processed as quickly as the law requires the IRS to act and your rights are protected

If you need help with tax debt resolution or IRS representation, don’t hesitate to call Tax On Wheels, LLC for a free initial consultation today at 877 439-3514.

January 12, 2023

In recent years, the gig economy has changed how people do business and provide services. Taxpayers must report their gig economy earnings on a tax return – whether they earned that money through a part-time, temporary or side gig. The IRS’ Gig Economy Tax Center provides information and resources to help this group of entrepreneurs and workers understand and meet their federal tax obligations.

Here are key things for individuals involved in the gig economy to remember as they get ready to file in 2023.

Gig economy income is taxable

- Taxpayers must report all income on their tax return unless excluded by law, whether they receive an information return such as a 1099 or not.

- Individuals involved in the gig economy may also be required to make quarterly estimated tax payments to pay income tax and self-employment tax, which includes Social Security and Medicare taxes. The last estimated tax payment for 2022 is due Jan. 17, 2023.

Workers report income according to their worker classification

Gig economy workers who perform services, such as driving a car for booked rides, running errands and other on demand work, must be correctly classified. Classification helps the taxpayer determine how to properly report their income.

- If they are employees, they report their wages from the Form W-2, Wage and Tax Statement.

- If they are an independent contractor, they report their income on a Schedule C, Form 1040, Profit or Loss from Business – Sole Proprietorship.

The business or the platform determines whether the individual providing the services is an employee or independent contractor. The business owners can use the worker classification page on IRS.gov for guidance on properly classifying employees and independent contractors.

Expenses related to gig economy income may be deductible

Individuals involved in the gig economy may be able to deduct expenses related to their gig income, depending on tax limits and rules.

- Taxpayers may be able to lower the amount of tax they owe by deducting certain expenses.

- It is important for taxpayers to keep records of their business expenses.

Pay the right amount of taxes throughout the year

An employer typically withholds income taxes from their employees’ pay to help cover taxes their employees owe.

Individuals involved in the gig economy have two ways to cover their taxes due:

- If they have another job where they are considered an employee, they can submit a new Form W-4, Employee’s Withholding Certificate to their employer to have more taxes withheld from their paycheck to cover the tax owed from their gig economy activity.

- They can make quarterly estimated tax payments throughout the year.

Please feel free to reach out to Tax On Wheels, LLC at 803 732-4288 if you need additional information on this or any other tax topic.

More information:

Publication 525 Taxable and Nontaxable Income

Publication 1779, Independent Contractor or Employee

February 6, 2021

WASHINGTON – The Internal Revenue Service reminds taxpayers to avoid “ghost” tax return preparers whose refusal to sign returns can cause a frightening array of problems. It is important to file a valid, accurate tax return because the taxpayer is ultimately responsible for it.

Ghost preparers get their scary name because they don’t sign tax returns they prepare. Like a ghost, they try to be invisible to the fact they’ve prepared the return and will print the return and get the taxpayer to sign and mail it. For e-filed returns, the ghost preparer will prepare but refuse to digitally sign it as the paid preparer.

By law, anyone who is paid to prepare or assists in preparing federal tax returns must have a valid Preparer Tax Identification Number, or PTIN. Paid preparers must sign and include their PTIN on the return. Not signing a return is a red flag that the paid preparer may be looking to make a fast buck by promising a big refund or charging fees based on the size of the refund.

Unscrupulous tax return preparers may also:

- Require payment in cash only and not provide a receipt.

- Invent income to qualify their clients for tax credits.

- Claim fake deductions to boost the size of the refund.

- Direct refunds into their bank account, not the taxpayer’s account.

The IRS urges taxpayers to choose a tax return preparer wisely. The Choosing a Tax Professional page on IRS.gov has information about tax preparer credentials and qualifications. The IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications can help identify many preparers by type of credential or qualification.

No matter who prepares the return, the IRS urges taxpayers to review it carefully and ask questions about anything not clear before signing. Taxpayers should verify both their routing and bank account number on the completed tax return for any direct deposit refund. And taxpayers should watch out for preparers putting their bank account information onto the returns.

Taxpayers can report preparer misconduct to the IRS using IRS Form 14157, Complaint: Tax Return Preparer. If a taxpayer suspects a tax preparer filed or changed their tax return without their consent, they should file Form 14157-A, Tax Return Preparer Fraud or Misconduct Affidavit.

At Tax On Wheels, LLC, we proudly sign all our returns and we stand behind our work. Please give us a call at 803 732-4288 if we can assist you with your tax filing needs.

April 9, 2020

WASHINGTON — To help taxpayers, the Department of Treasury and the Internal Revenue Service announced today that Notice 2020-23 extends additional key tax deadlines for individuals and businesses.

Last month, the IRS announced that taxpayers generally have until July 15, 2020, to file and pay federal income taxes originally due on April 15. No late-filing penalty, late-payment penalty or interest will be due.

Today’s notice expands this relief to additional returns, tax payments and other actions. As a result, the extensions generally now apply to all taxpayers that have a filing or payment deadline falling on or after April 1, 2020, and before July 15, 2020. Individuals, trusts, estates, corporations and other non-corporate tax filers qualify for the extra time. This means that anyone, including Americans who live and work abroad, can now wait until July 15 to file their 2019 federal income tax return and pay any tax due.

Extension of time to file beyond July 15

Individual taxpayers who need additional time to file beyond the July 15 deadline can request an extension to Oct. 15, 2020, by filing Form 4868 through their tax professional, tax software or using the Free File link on IRS.gov. Businesses who need additional time must file Form 7004. An extension to file is not an extension to pay any taxes owed. Taxpayers requesting additional time to file should estimate their tax liability and pay any taxes owed by the July 15, 2020, deadline to avoid additional interest and penalties.

Estimated Tax Payments

Besides the April 15 estimated tax payment previously extended, today’s notice also extends relief to estimated tax payments due June 15, 2020. This means that any individual or corporation that has a quarterly estimated tax payment due on or after April 1, 2020, and before July 15, 2020, can wait until July 15 to make that payment, without penalty.

2016 unclaimed refunds – deadline extended to July 15

For 2016 tax returns, the normal April 15 deadline to claim a refund has also been extended to July 15, 2020. The law provides a three-year window of opportunity to claim a refund. If taxpayers do not file a return within three years, the money becomes property of the U.S. Treasury. The law requires taxpayers to properly address, mail and ensure the tax return is postmarked by the July 15, 2020, date.

IRS.gov assistance 24/7

IRS live telephone assistance is currently unavailable due to COVID-19. Normal operations will resume when possible. Tax help is available 24 hours a day on IRS.gov. The IRS website offers a variety of online tools to help taxpayers answer common tax questions. For example, taxpayers can search the Interactive Tax Assistant, Tax Topics, Frequently Asked Questions, and Tax Trails to get answers to common questions. Those who have already filed can check their refund status by visiting IRS.gov/Refunds.

Tax On Wheels, LLC is here to assist you. Please call us at 803 732-4288 if we can assist you in meeting your tax filing obligations.

IR-2020-61, March 30, 2020

WASHINGTON – The Treasury Department and the Internal Revenue Service today announced that distribution of economic impact payments will begin in the next three weeks and will be distributed automatically, with no action required for most people. However, some seniors and others who typically do not file returns will need to submit a simple tax return to receive the stimulus payment.

Who is eligible for the economic impact payment?

Tax filers with adjusted gross income up to $75,000 for individuals and up to $150,000 for married couples filing joint returns will receive the full payment. For filers with income above those amounts, the payment amount is reduced by $5 for each $100 above the $75,000/$150,000 thresholds. Single filers with income exceeding $99,000 and $198,000 for joint filers with no children are not eligible.

Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to $1,200 for individuals or $2,400 for married couples. Parents also receive $500 for each qualifying child.

How will the IRS know where to send my payment?

The vast majority of people do not need to take any action. The IRS will calculate and automatically send the economic impact payment to those eligible.

For people who have already filed their 2019 tax returns, the IRS will use this information to calculate the payment amount. For those who have not yet filed their return for 2019, the IRS will use information from their 2018 tax filing to calculate the payment. The economic impact payment will be deposited directly into the same banking account reflected on the return filed.

The IRS does not have my direct deposit information. What can I do?

In the coming weeks, Treasury plans to develop a web-based portal for individuals to provide their banking information to the IRS online, so that individuals can receive payments immediately as opposed to checks in the mail.

I am not typically required to file a tax return. Can I still receive my payment?

Yes. People who typically do not file a tax return will need to file a simple tax return to receive an economic impact payment. Low-income taxpayers, senior citizens, Social Security recipients, some veterans and individuals with disabilities who are otherwise not required to file a tax return will not owe tax.

How can I file the tax return needed to receive my economic impact payment?

IRS.gov/coronavirus will soon provide information instructing people in these groups on how to file a 2019 tax return with simple, but necessary, information including their filing status, number of dependents and direct deposit bank account information.

I have not filed my tax return for 2018 or 2019. Can I still receive an economic impact payment?

Yes. The IRS urges anyone with a tax filing obligation who has not yet filed a tax return for 2018 or 2019 to file as soon as they can to receive an economic impact payment. Taxpayers should include direct deposit banking information on the return.

I need to file a tax return. How long are the economic impact payments available?

For those concerned about visiting a tax professional or local community organization in person to get help with a tax return, these economic impact payments will be available throughout the rest of 2020.

Where can I get more information?

The IRS will post all key information on IRS.gov/coronavirus as soon as it becomes available.

The IRS has a reduced staff in many of its offices but remains committed to helping eligible individuals receive their payments expeditiously. Check for updated information on IRS.gov/coronavirus rather than calling IRS assistors who are helping process 2019 returns.

Please feel free to contact Tax On Wheels, LLC at 803 732-4288 if we can assist you with securing your economic stimulus payment.

December 30 2018

Despite the ongoing government shutdown, tax season is essentially upon us. If not resolved, the shutdown could delay the official start of tax season, as defined by the date the IRS begins accepting and processing tax returns.

But even though the government may allow themselves to ignore their responsibilities, that privilege does not apply to me and you my friends. So in the interest of helping you make sure you timely fulfill your tax filing obligations I call your attention to this list of items to bring to your tax appointment. It’s an oldie but a goody.

Otherwise there is not much more you can do right now. However, you need to be aware that the TCJA (Tax Cuts and Jobs Act) has imposed substantial changes on the tax system. Everything from the look of the tax forms to the way claiming your dependents impacts your refund has changed. Almost everything will be different. So if you are one of those people that just kind of copies everything from last years return onto the current years return, that won’t work this year.

We are here to help. If you have any questions please do not hesitate to contact Tax On Wheels, LLC at 803 732-4288. We will be glad to answer your questions free of charge.

September 15, 2018

WASHINGTON — Hurricane Florence victims in parts of North Carolina and elsewhere have until Jan. 31, 2019, to file certain individual and business tax returns and make certain tax payments, the Internal Revenue Service announced today.

The IRS is offering this relief to any area designated by the Federal Emergency Management Agency (FEMA), as qualifying for individual assistance. Currently, this only includes parts of North Carolina, but taxpayers in localities added later to the disaster area, including those in other states, will automatically receive the same filing and payment relief. The current list of eligible localities is always available on the disaster relief page on IRS.gov.

The tax relief postpones various tax filing and payment deadlines that occurred starting on Sept. 7, 2018 in North Carolina. As a result, affected individuals and businesses will have until Jan. 31, 2019, to file returns and pay any taxes that were originally due during this period.

This includes quarterly estimated income tax payments due on Sept. 17, 2018, and the quarterly payroll and excise tax returns normally due on Sept. 30, 2018. Businesses with extensions also have the additional time including, among others, calendar-year partnerships whose 2017 extensions run out on Sept. 17, 2018. Taxpayers who had a valid extension to file their 2017 return due to run out on Oct. 15, 2018 will also have more time to file.

In addition, penalties on payroll and excise tax deposits due on or after Sept. 7, 2018, and before Sept. 24, 2018, will be abated as long as the deposits are made by Sept. 24, 2018.

The IRS disaster relief page has details on other returns, payments and tax-related actions qualifying for the additional time.

The IRS automatically provides filing and penalty relief to any taxpayer with an IRS address of record located in the disaster area. Thus, taxpayers need not contact the IRS to get this relief. However, if an affected taxpayer receives a late filing or late payment penalty notice from the IRS that has an original or extended filing, payment or deposit due date falling within the postponement period, the taxpayer should call the number on the notice to have the penalty abated.

In addition, the IRS will work with any taxpayer who lives outside the disaster area but whose records necessary to meet a deadline occurring during the postponement period are located in the affected area. Taxpayers qualifying for relief who live outside the disaster area need to contact the IRS at 866-562-5227. This also includes workers assisting the relief activities who are affiliated with a recognized government or philanthropic organization.

Individuals and businesses in a federally declared disaster area who suffered uninsured or unreimbursed disaster-related losses can choose to claim them on either the return for the year the loss occurred (in this instance, the 2018 return normally filed next year), or the return for the prior year (2017). See Publication 547 for details.

The tax relief is part of a coordinated federal response to the damage caused by severe storms and flooding and is based on local damage assessments by FEMA. For information on disaster recovery, visit disasterassistance.gov.

Please feel free to contact Tax On Wheels, LLC at 803 732-4288 if you need assistance in meeting your tax filing obligations.

IRS YouTube Videos:

- Tax Return Errors – Tips to Avoid Them English | Spanish | ASL

- Owe Taxes But Can’t Pay? English | Spanish | ASL

- IRS Taxes – Three Easy Ways to Pay English | Spanish | ASL

- Direct Deposit for Your Tax Refund English | Spanish | ASL

- When Will I Get My Refund? English | Spanish |ASL

WASHINGTON –The federal income tax filing deadline has arrived and the IRS estimates it will receive approximately 12 million 2016 federal income tax returns and nearly 8.4 million extension requests in the final days of the filing season.

For those taxpayers who have yet to file, the IRS offers this advice:

- E-file The IRS encourages taxpayers to file electronically. E-file vastly reduces tax return errors, as the tax software does the calculations, flags common errors and prompts taxpayers for missing information. Free File partners make their brand-name software products available for free to taxpayers earning $64,000 or less. Taxpayers who earned more may use Free File Fillable Forms. For the first time, taxpayers also can prepare their taxes from their mobile phone or tablet as well as computer. Taxpayers who changed tax software products, either using Free File or other software products, this year may be asked for their Adjusted Gross Income to verify their identity. See Validating Your Electronically Filed Tax Return for details.

- Refunds The fastest way for taxpayers to get their refund is to e-file and have it electronically deposited into their bank or other financial account. The IRS issues more than nine out of 10 refunds in less than 21 days. Taxpayers waiting to receive their refunds can use the “Where’s My Refund?” tool on IRS.gov or check the status of their refund through the smartphone app, IRS2Go. The “Where’s My Refund?” tool is updated once daily, usually overnight, so there’s no reason to check more than once per day or call the IRS to get information about a refund. Taxpayers can check “Where’s My Refund?” within 24 hours after the IRS has received an e-filed return or four weeks after receipt of a mailed paper return. “Where’s My Refund?” has a tracker that displays progress through three stages: (1) Return Received, (2) Refund Approved and (3) Refund Sent.

- Payment Options Many taxpayers who owe money often wait until the last minute to file. Taxpayers who owe have many payment options. They can pay online, by phone or with their mobile device using the IRS2Go app. Available payment options include Direct Pay; Electronic Federal Tax Payment System (EFTPS); electronic funds withdrawal; same-day wire; debit or credit card; check or money order; or cash. Some of these options are free; others require a fee.

- File an Extension Taxpayers who are not ready to file by the deadline should request an extension. An extension gives the taxpayer until Oct. 16 to file but does not extend the time to pay. Interest and penalties will be charged on all taxes not paid by the April 18 filing deadline. Although some people automatically get an extension – such as those in a federally declared disaster area – most people need to request one. One way to get an extension is through Free File on IRS.gov where some partners offer free electronic filing of the extension request. Extensions are free for everyone, regardless of income. Another option for taxpayers is to pay electronically to get an extension. IRS will automatically process an extension when taxpayers select Form 4868 and they are making a full or partial federal tax payment using Direct Pay, Electronic Federal Tax Payment System or a debit or credit card by the April due date. There is no need to file a separate Form 4868 when making an electronic payment and indicating it is for a 4868 or extension. Electronic payment options are available at IRS.gov/payments. Taxpayers can also download, print and file a paper Form 4868 from IRS.gov/forms. The form must be mailed to the IRS with a postmark on or before midnight on April 18.

- Penalties and Interest Taxpayers who are thinking of missing the filing deadline because they can’t pay all of the taxes they owe should consider filing and paying what they can to lessen interest and penalties. Penalties for those who owe tax and fail to file either a tax return or an extension request by April 18 can be higher than if they had filed and not paid the taxes they owed. That’s because the failure-to-file penalty is generally 5 percent per month and can be as much as 25 percent of the unpaid tax, depending on how late a taxpayer files. The failure-to-pay penalty, which is the penalty for any taxes not paid by the deadline, is ½ of 1 percent of the unpaid taxes per month. The failure-to-pay penalty continues to accrue on any unpaid tax balance and can be up to 25 percent of the unpaid amount. Taxpayers must also pay interest, currently at the annual rate of 4 percent, compounded daily, on taxes not paid by the filing deadline.

- Installment Agreements Taxpayers who find they are unable to pay the entire amount of taxes due should consider filing the return and requesting a payment agreement. Most people can set up a payment plan with the IRS online in a matter of minutes. Those who owe $50,000 or less in combined tax, penalties and interest can use the Online Payment Agreement application to set up a short-term payment plan of 120-days or less, or a monthly payment agreement for up to 72 months. With the Online Payment Agreement, no paperwork is required, there is no need to call, write or visit the IRS and qualified taxpayers can avoid the IRS filing a Notice of Federal Tax Lien unless it previously filed one. Alternatively, taxpayers can request a payment agreement by filing Form 9465. This form can be downloaded from IRS.gov and mailed along with a tax return, IRS bill or notice.

No matter how or when they file, taxpayers are reminded to keep a copy of their tax return and all supporting documents.

And if all of that is too much to bear, remember, Tax On Wheels, LLC will be glad to handle it all for you. Just give us a call at 803 732-4288.

November 18. 2016

Plan ahead for the coming tax filing season.

There are important changes you should know about before the 2017 filing season begins. If you are a client of Tax On Wheels, LLC we will take care of everything for you. If, on the other hand, you are the do it yourself type, there are a couple of things like refund delays and electronic filing procedures you should factor into your tax preparation regimen.

The IRS lays out all of the details on its website, IRS.gov/GetReady to help taxpayers understand the changes that may affect the processing of tax returns and release of refunds. We encourage you to review this page now before tax season so that you will be ready for what is in place now.

As always, please feel free to contact Tax On Wheels, LLC at 803 732-4288 if we can be of assistance to you.