March 30, 2023

WASHINGTON – As part of the annual Dirty Dozen tax scams series, the Internal Revenue Service today renewed a warning about so-called Offer in Compromise “mills” that often mislead taxpayers into believing they can settle a tax debt for pennies on the dollar.

The IRS continues to see instances of heavily advertised promises offering to settle taxpayer debt at steep discounts. The IRS sees many situations where taxpayers don’t meet the technical requirements for an offer, but they had to face excessive fees from promoters for information they can easily obtain themselves.

Offer in Compromise mills highlight day nine of the Dirty Dozen series. Offers in Compromise are an important program to help people who can’t pay to settle their federal tax debts. But “mills” can aggressively promote Offers in Compromise in misleading ways to people who clearly don’t meet the qualifications, frequently costing taxpayers thousands of dollars.

A taxpayer can check their eligibility for free using the IRS’s Offer in Compromise Pre-Qualifier tool.

“Too often, we see some unscrupulous promoters mislead taxpayers into thinking they can magically get rid of a tax debt,” said IRS Commissioner Danny Werfel. “This is a legitimate IRS program, but there are specific requirements for people to qualify. People desperate for help can make a costly mistake if they clearly don’t qualify for the program. Before using an aggressive promoter, we encourage people to review readily available IRS resources to help resolve a tax debt on their own without facing hefty fees.”

The Dirty Dozen is an annual IRS list of 12 scams and schemes that put taxpayers and the tax professional community at risk of losing money, personal data and more. Some items on the list are new and some make a return visit. While the list is not a legal document or a formal listing of agency enforcement priorities, it is intended to alert taxpayers, businesses and tax preparers about scams at large.

Working together as the Security Summit, the IRS, state tax agencies and the nation’s tax industry have taken numerous steps to warn people about common scams and schemes during tax season and beyond. The Security Summit initiative is committed to protecting taxpayers, businesses and the tax system from scammers and identity thieves.

Watch to watch out for: Offer in Compromise mills

An Offer in Compromise (OIC) is when the taxpayer works with the IRS to settle a tax debt for less than the full amount owed. It is an option for those unable to pay the full tax liability or if doing so creates a financial hardship. The IRS takes in consideration each unique set of facts and circumstances. This agreement can happen directly between the taxpayer and the IRS without a third party.

An Offer in Compromise “mill” will usually make outlandish claims, frequently in radio and TV ads, about how they can settle a person’s tax debt for cheap. In reality, the promoter fees are often excessive, and taxpayers pay the OIC mill to get the same deal they could have received on their own by working directly with the IRS. This takes unnecessary money out of the taxpayer’s wallet.

In addition, not every taxpayer will qualify for an OIC. Some promoters knowingly advise indebted taxpayers to file an OIC application even though the promoters know the person will not qualify, costing honest taxpayers money and time.

The IRS urges people to take a few minutes to review information on IRS.gov to see if they might be a good candidate for the OIC program – and avoid costly promoters. As a first step, a taxpayer can check their OIC eligibility for free using the IRS’s Offer in Compromise Pre-Qualifier tool. And the IRS reminds taxpayers about the First Time Penalty Abatement policy, where taxpayers can go directly to the IRS for administrative relief from a penalty that would otherwise be added to their tax debt.

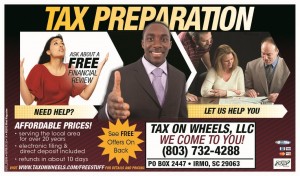

Tax On Wheels, LLC offers legitimate services to assist you with your IRS debt. Sometimes the best answer is to simply pay your bill, either in installments or with a single lump sum. However, you may fit into a category that will allow you some relief on your tax debts. Tax On Wheels, LLC can assist you with:

-

- Bringing you into compliance by preparing and filing all past due tax returns

- Determining if you have criminal exposure and will need to consult with a tax attorney

- Evaluating your tax debt and your personal financial situation to determine if you might be eligible for any of several tax debt relief tools available from the IRS

- Developing a strategy for using any of the legally available tools to minimize the amount of your tax debt you actually have to pay

- Preparing and submitting the necessary forms and requests to obtain the tax relief that you are entitled to under the law, up to and including possible total elimination of your tax debt.

- Providing ongoing monitoring and assistance in dealing with the IRS bureaucracy to insure your application is processed as quickly as the law requires the IRS to act and your rights are protected

If you need help with tax debt resolution or IRS representation, don’t hesitate to call Tax On Wheels, LLC for a free initial consultation today at 877 439-3514.

February 16, 2023

A few minutes spent reviewing income tax withholding early in the year helps set a taxpayer up for success all year long. The Tax Withholding Estimator on IRS.gov makes it easy to figure out how much to withhold.

This online tool helps employees withhold the correct amount of tax from their wages. It also helps self-employed people who have wage income estimate their quarterly tax payments.

The Tax Withholding Estimator does not ask for personally identifiable information, such as name, Social Security number, address and bank account numbers. The IRS doesn’t save or record the information users enter in the Estimator.

Why use the Tax Withholding Estimator

Using this tool to estimate tax withholding can help taxpayers avoid unpleasant surprises. Having too little withheld can result in a tax bill or even a penalty at tax time. Having too much withheld may result in a projected refund, which could mean less money in the taxpayer’s pocket during the year. The Tax Withholding Estimator can help taxpayers decide how much to withhold to get to a balance of zero or to a desired refund amount.

Taxpayers can use the results from the Tax Withholding Estimator to decide if they should:

- Complete a new Form W-4, Employee’s Withholding Allowance Certificate and submit it to their employer, or

- Make an additional estimated tax payment to the IRS.

Before using the tool, taxpayers may want to gather a few documents, including:

- Pay stubs for all jobs. If the taxpayer married filing jointly, they would also need their spouses’ pay stubs.

- Forms W-2 from employers to estimate their annual income.

- Forms 1099 from banks, issuing agencies and other payers including unemployment compensation, dividends, distributions from a pension, annuity or retirement plan.

- Form 1099-K, 1099-MISC, W-2 or other income statement for workers in the gig economy.

- Form 1099-INT for interest received.

- Other income documents and records of virtual currency transactions.

People do not need these documents use the tool but having them will help taxpayers estimate 2023 income and answer other questions asked during the process. The Tax Withholding Estimator results will only be as accurate as the information the taxpayer enters.

The Tax Withholding Estimator isn’t for taxpayers who

- Only have pension income – They can read more about pension and annuity withholding on IRS.gov.

- Have more complex tax situations – This includes taxpayers who owe certain taxes such as the alternative minimum tax and people with long-term capital gains or qualified dividends.

Tax On Wheels, LLC is available to assist you with this or any other tax related needs. Give us a call at 803 732-4288 if we can be of assistance to you

January 12, 2023

In recent years, the gig economy has changed how people do business and provide services. Taxpayers must report their gig economy earnings on a tax return – whether they earned that money through a part-time, temporary or side gig. The IRS’ Gig Economy Tax Center provides information and resources to help this group of entrepreneurs and workers understand and meet their federal tax obligations.

Here are key things for individuals involved in the gig economy to remember as they get ready to file in 2023.

Gig economy income is taxable

- Taxpayers must report all income on their tax return unless excluded by law, whether they receive an information return such as a 1099 or not.

- Individuals involved in the gig economy may also be required to make quarterly estimated tax payments to pay income tax and self-employment tax, which includes Social Security and Medicare taxes. The last estimated tax payment for 2022 is due Jan. 17, 2023.

Workers report income according to their worker classification

Gig economy workers who perform services, such as driving a car for booked rides, running errands and other on demand work, must be correctly classified. Classification helps the taxpayer determine how to properly report their income.

- If they are employees, they report their wages from the Form W-2, Wage and Tax Statement.

- If they are an independent contractor, they report their income on a Schedule C, Form 1040, Profit or Loss from Business – Sole Proprietorship.

The business or the platform determines whether the individual providing the services is an employee or independent contractor. The business owners can use the worker classification page on IRS.gov for guidance on properly classifying employees and independent contractors.

Expenses related to gig economy income may be deductible

Individuals involved in the gig economy may be able to deduct expenses related to their gig income, depending on tax limits and rules.

- Taxpayers may be able to lower the amount of tax they owe by deducting certain expenses.

- It is important for taxpayers to keep records of their business expenses.

Pay the right amount of taxes throughout the year

An employer typically withholds income taxes from their employees’ pay to help cover taxes their employees owe.

Individuals involved in the gig economy have two ways to cover their taxes due:

- If they have another job where they are considered an employee, they can submit a new Form W-4, Employee’s Withholding Certificate to their employer to have more taxes withheld from their paycheck to cover the tax owed from their gig economy activity.

- They can make quarterly estimated tax payments throughout the year.

Please feel free to reach out to Tax On Wheels, LLC at 803 732-4288 if you need additional information on this or any other tax topic.

More information:

Publication 525 Taxable and Nontaxable Income

Publication 1779, Independent Contractor or Employee

December 14, 2021

As taxpayers get ready to file their 2022 tax return, they may be considering hiring a tax return preparer. The IRS reminds taxpayers to choose a tax return preparer wisely. This is important because taxpayers are responsible for all the information on their return, no matter who prepares it for them.

There are different kinds of tax preparers, and a taxpayer’s needs will help determine which kind of preparer is best for them. With that in mind, here are some quick tips to help people choose a preparer.

When choosing a tax professional, taxpayers should:

- Check the IRS Directory of Preparers. While it is not a complete listing of tax return preparers, it does include those who are enrolled agents, CPAs and attorneys, as well as those who participate in the Annual Filing Season Program.

- Check the preparer’s history with the Better Business Bureau. Taxpayers can verify an enrolled agent’s status on IRS.gov.

- Ask about fees. Taxpayers should avoid tax return preparers who base their fees on a percentage of the refund or who offer to deposit all or part of their refund into their financial accounts.

- Be wary of tax return preparers who claim they can get larger refunds than others.

- Ask if they plan to use e-file.

- Make sure the preparer is available. People should consider whether the individual or firm will be around for months or years after filing the return. Taxpayers should do this because they might need the preparer to answer questions about the preparation of the tax return.

- Ensure the preparer signs and includes their preparer tax identification number. Paid tax return preparers must have a PTIN to prepare tax returns.

- Check the person’s credentials. Only attorneys, CPAs and enrolled agents can represent taxpayers before the IRS in tax matters. Other tax return preparers who participate in the IRS Annual Filing Season Program have limited practice rights to represent taxpayers during audits of returns they prepared.

July 1, 2021

WASHINGTON — The Internal Revenue Service today upgraded a key online tool to enable families to quickly and easily update their bank account information so they can receive their monthly Child Tax Credit payment.

The bank account update feature was added to the Child Tax Credit Update Portal, available only on IRS.gov. Any updates made by Aug. 2 will apply to the Aug. 13 payment and all subsequent monthly payments for the rest of 2021.

Families will receive their July 15 payment by direct deposit in the bank account currently on file with the IRS. Those who are not enrolled for direct deposit will receive a check. The IRS encourages people without current bank account information to use the tool to update their information so they can get the payments sooner.

The IRS also urges people to be on the lookout for scams related to the Child Tax Credit. People who need to update their bank account information should go directly to the IRS.gov site and not click on links received by email, text or phone.

How to update direct deposit information

First, families should use the Child Tax Credit Update Portal to confirm their eligibility for the payments. If eligible, the tool will also indicate whether they are enrolled to receive their payments by direct deposit.

If so, it will list the full bank routing number and the last four digits of their account number. This is the account that will receive their July 15 payment, and if they don’t change the account, all future payments will go there as well.

Next, if they choose, they can change the bank account receiving the payment starting with the Aug. 13 payment. They can do that by updating the routing number and account number and indicating whether it is a savings or checking account. Note that only one account number is permitted for each recipient—that is, the entire payment must be direct deposited in only one account.

How to switch from paper check to direct deposit

If the Update Portal shows that a family is eligible to receive payments but not enrolled to receive direct deposits, they will receive a check each month. If they want to switch to receiving their payments by direct deposit, they can use the tool to add their bank account information. They do that by entering their bank routing number and account number and indicating whether it is a savings or checking account.

The IRS urges any family receiving checks to consider switching to direct deposit. With direct deposit, families can access their money more quickly. Direct deposit removes the time, worry and expense of cashing a check. In addition, direct deposit eliminates the chance of a lost, stolen or undelivered check.

Families can stop payments anytime

Even after payments begin, families can stop all future monthly payments if they choose. They do that by using the unenroll feature in the Child Tax Credit Update Portal. Eligible families who make this choice will still receive the rest of their Child Tax Credit as a lump sum when they file their 2021 federal income tax return next year.

To stop all payments starting in August and the rest of 2021, they must unenroll by Aug. 2, 2021.

For more information about the unenrollment process, including a schedule of deadlines for each monthly payment, see Topic J of the Child Tax Credit FAQs on IRS.gov.

Who should unenroll?

Instead of receiving these advance payments, some families may prefer to wait until the end of the year and receive the entire credit as a refund when they file their 2021 return. The Child Tax Credit Update Portal enables these families to quickly and easily do that.

The unenroll feature can also be helpful to any family that no longer qualifies for the Child Tax Credit or believes they will not qualify when they file their 2021 return. This could happen if, for example:

- Their income in 2021 is too high to qualify them for the credit.

- Someone else (an ex-spouse or another family member, for example) qualifies to claim their child or children as dependents in 2021.

- Their main home was outside of the United States for more than half of 2021.

What is the Child Tax Credit Update Portal?

The Child Tax Credit Update Portal is a secure, password-protected tool, available to any eligible family with internet access and a smart phone or computer. It is designed to enable them to manage their Child Tax Credit accounts. Right now, this includes updating their bank account information with the IRS or unenrolling from monthly payments. Soon, it will allow people to check on the status of their payments. Later this year, the tool will also enable them to make other status updates and be available in Spanish.

To access the Child Tax Credit Update Portal, a person must first verify their identity. If a person has an existing IRS username or an ID.me account with a verified identity, they can use those accounts to easily sign in. People without an existing account will be asked to verify their identity with a form of photo identification using ID.me, a trusted third party for the IRS. Identity verification is an important safeguard and will protect the user’s account from identity theft.

Anyone who lacks internet access or otherwise cannot use the online tool may unenroll by contacting the IRS at the phone number included in the outreach letter they received from the IRS.

Who is getting a monthly payment?

In general, monthly payments will go to eligible families who:

- Filed either a 2019 or 2020 federal income tax return.

- Used the Non-Filers tool on IRS.gov in 2020 to register for an Economic Impact Payment.

- Registered for the advance Child Tax Credit this year using the new Non-Filer Sign-Up Tool on IRS.gov.

An eligible family who took any of these steps does not need to do anything else to get their payments.

Normally, the IRS will calculate the advance payment based on the 2020 income tax return. If that return is not available, either because it has not yet been filed or it has not yet been processed, the IRS is instead determining the payment using the 2019 tax return.

Eligible families will receive advance payments, either by direct deposit or check. Each payment will be up to $300 per month for each child under age 6 and up to $250 per month for each child ages 6 through 17. The IRS will issue advance Child Tax Credit payments on these dates: July 15, Aug. 13, Sept. 15, Oct. 15, Nov. 15 and Dec. 15.

Tax returns processed by June 28 will be reflected in the first batch of monthly payments scheduled for July 15.

Taxpayers will receive several letters

Taxpayers will also receive several letters related to the Child Tax Credit. In the next few weeks, letters are going to eligible families who filed either a 2019 or 2020 federal income tax return or who used the Non-Filers tool on IRS.gov to register for an Economic Impact Payment. The letters will confirm their eligibility, the amount of payments they’ll receive and that the payments begin July 15. Families who receive these letters do not need to take any further action. The personalized letters follow up on the Advance Child Tax Credit Outreach Letter, sent in early- and mid-June, to every family who appeared to qualify for the advance payments.

Child Tax Credit 2021

The IRS has created a special Advance Child Tax Credit 2021 page, designed to provide the most up-to-date information about the credit and the advance payments. It’s at IRS.gov/childtaxcredit2021.

Among other things, it provides direct links to the Child Tax Credit Update Portal, as well as two other online tools −the Non-filer Sign-up Tool and the Child Tax Credit Eligibility Assistant, a set of frequently asked questions and other useful resources.

Child Tax Credit changes

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to $3,600 for children under the age of 6 and to $3,000 per child for children ages 6 through 17. Before 2021, the credit was worth up to $2,000 per eligible child.

The new maximum credit is available to taxpayers with a modified adjusted gross income (AGI) of:

- $75,000 or less for singles,

- $112,500 or less for heads of household and

- $150,000 or less for married couples filing a joint return and qualified widows and widowers.

For most people, modified AGI is the amount shown on Line 11 of their 2020 Form 1040 or 1040-SR. Above these income thresholds, the extra amount above the original $2,000 credit — either $1,000 or $1,600 per child — is reduced by $50 for every $1,000 in modified AGI. In addition, the credit is fully refundable for 2021. This means that eligible families can get it, even if they owe no federal income tax. Before this year, the refundable portion was limited to $1,400 per child.

For the most up-to-date information on the Child Tax Credit and advance payments, visit Advance Child Tax Credit Payments in 2021.

As always, Tax On Wheels, LLC is help you with this or any other tax related issue; feel free to call us at 803 732-4288 if we may be of assistance to you.

February 6, 2021

WASHINGTON – The Internal Revenue Service reminds taxpayers to avoid “ghost” tax return preparers whose refusal to sign returns can cause a frightening array of problems. It is important to file a valid, accurate tax return because the taxpayer is ultimately responsible for it.

Ghost preparers get their scary name because they don’t sign tax returns they prepare. Like a ghost, they try to be invisible to the fact they’ve prepared the return and will print the return and get the taxpayer to sign and mail it. For e-filed returns, the ghost preparer will prepare but refuse to digitally sign it as the paid preparer.

By law, anyone who is paid to prepare or assists in preparing federal tax returns must have a valid Preparer Tax Identification Number, or PTIN. Paid preparers must sign and include their PTIN on the return. Not signing a return is a red flag that the paid preparer may be looking to make a fast buck by promising a big refund or charging fees based on the size of the refund.

Unscrupulous tax return preparers may also:

- Require payment in cash only and not provide a receipt.

- Invent income to qualify their clients for tax credits.

- Claim fake deductions to boost the size of the refund.

- Direct refunds into their bank account, not the taxpayer’s account.

The IRS urges taxpayers to choose a tax return preparer wisely. The Choosing a Tax Professional page on IRS.gov has information about tax preparer credentials and qualifications. The IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications can help identify many preparers by type of credential or qualification.

No matter who prepares the return, the IRS urges taxpayers to review it carefully and ask questions about anything not clear before signing. Taxpayers should verify both their routing and bank account number on the completed tax return for any direct deposit refund. And taxpayers should watch out for preparers putting their bank account information onto the returns.

Taxpayers can report preparer misconduct to the IRS using IRS Form 14157, Complaint: Tax Return Preparer. If a taxpayer suspects a tax preparer filed or changed their tax return without their consent, they should file Form 14157-A, Tax Return Preparer Fraud or Misconduct Affidavit.

At Tax On Wheels, LLC, we proudly sign all our returns and we stand behind our work. Please give us a call at 803 732-4288 if we can assist you with your tax filing needs.

April 14, 2020

Employed full or part time? Unemployed? A temporary or gig worker? Retired or disabled? Receive public benefits? Have no income? Most U.S. residents – under certain income levels – will receive the Economic Impact Payment if they are not claimed as a dependent of another taxpayer and have a Social Security number.

Here’s how much the payments will be:

- Eligible individuals will receive up to $1,200.

- Eligible married couples will receive up to $2,400.

- Eligible individuals will receive up to $500 for each qualifying child.

Taxpayers will receive a reduced payment if their adjusted gross income is between:

- $75,000 and $99,000 if their filing status was single or married filing separately

- $112,500 and $136,500 for head of household

- $150,000 and $198,000 if their filing status was married filing jointly

Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an Economic Impact Payment.

Payments will also be automatic for people who receive Social Security retirement, disability (SSDI), or survivor benefits or Railroad Retirement benefits who don’t normally file a tax return. Those receiving these benefits who aren’t claimed as a dependent on someone else’s return or required to file a tax return are eligible for a $1,200 payment. However, people in this group who have qualifying children under age 17 will need to provide information using the Non-Filers: Enter Payment Info tool to claim the $500 payment per child.

The IRS encourages people to share this information with family and friends. Some people who normally don’t file a tax return may not realize they’re eligible for an Economic Impact Payment.

For additional and updated information, visit the Coronavirus Tax Relief page on IRS.gov.

More information:

Economic Impact Payment

Adjusted Gross Income

Economic Impact Payments e-Poster

Do I Need to File a Tax Return?

Whom May I Claim as a Dependent?

What Is My Filing Status?

If you need assistance with this information or any tax matter you may reach Tax On Wheels, LLC at 803 732-4288 for individual assistance.

#IRSTaxTip: Read this information on the IRS website https://go.usa.gov/xvKm8

April 9, 2020

WASHINGTON — To help taxpayers, the Department of Treasury and the Internal Revenue Service announced today that Notice 2020-23 extends additional key tax deadlines for individuals and businesses.

Last month, the IRS announced that taxpayers generally have until July 15, 2020, to file and pay federal income taxes originally due on April 15. No late-filing penalty, late-payment penalty or interest will be due.

Today’s notice expands this relief to additional returns, tax payments and other actions. As a result, the extensions generally now apply to all taxpayers that have a filing or payment deadline falling on or after April 1, 2020, and before July 15, 2020. Individuals, trusts, estates, corporations and other non-corporate tax filers qualify for the extra time. This means that anyone, including Americans who live and work abroad, can now wait until July 15 to file their 2019 federal income tax return and pay any tax due.

Extension of time to file beyond July 15

Individual taxpayers who need additional time to file beyond the July 15 deadline can request an extension to Oct. 15, 2020, by filing Form 4868 through their tax professional, tax software or using the Free File link on IRS.gov. Businesses who need additional time must file Form 7004. An extension to file is not an extension to pay any taxes owed. Taxpayers requesting additional time to file should estimate their tax liability and pay any taxes owed by the July 15, 2020, deadline to avoid additional interest and penalties.

Estimated Tax Payments

Besides the April 15 estimated tax payment previously extended, today’s notice also extends relief to estimated tax payments due June 15, 2020. This means that any individual or corporation that has a quarterly estimated tax payment due on or after April 1, 2020, and before July 15, 2020, can wait until July 15 to make that payment, without penalty.

2016 unclaimed refunds – deadline extended to July 15

For 2016 tax returns, the normal April 15 deadline to claim a refund has also been extended to July 15, 2020. The law provides a three-year window of opportunity to claim a refund. If taxpayers do not file a return within three years, the money becomes property of the U.S. Treasury. The law requires taxpayers to properly address, mail and ensure the tax return is postmarked by the July 15, 2020, date.

IRS.gov assistance 24/7

IRS live telephone assistance is currently unavailable due to COVID-19. Normal operations will resume when possible. Tax help is available 24 hours a day on IRS.gov. The IRS website offers a variety of online tools to help taxpayers answer common tax questions. For example, taxpayers can search the Interactive Tax Assistant, Tax Topics, Frequently Asked Questions, and Tax Trails to get answers to common questions. Those who have already filed can check their refund status by visiting IRS.gov/Refunds.

Tax On Wheels, LLC is here to assist you. Please call us at 803 732-4288 if we can assist you in meeting your tax filing obligations.

IR-2020-61, March 30, 2020

WASHINGTON – The Treasury Department and the Internal Revenue Service today announced that distribution of economic impact payments will begin in the next three weeks and will be distributed automatically, with no action required for most people. However, some seniors and others who typically do not file returns will need to submit a simple tax return to receive the stimulus payment.

Who is eligible for the economic impact payment?

Tax filers with adjusted gross income up to $75,000 for individuals and up to $150,000 for married couples filing joint returns will receive the full payment. For filers with income above those amounts, the payment amount is reduced by $5 for each $100 above the $75,000/$150,000 thresholds. Single filers with income exceeding $99,000 and $198,000 for joint filers with no children are not eligible.

Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to $1,200 for individuals or $2,400 for married couples. Parents also receive $500 for each qualifying child.

How will the IRS know where to send my payment?

The vast majority of people do not need to take any action. The IRS will calculate and automatically send the economic impact payment to those eligible.

For people who have already filed their 2019 tax returns, the IRS will use this information to calculate the payment amount. For those who have not yet filed their return for 2019, the IRS will use information from their 2018 tax filing to calculate the payment. The economic impact payment will be deposited directly into the same banking account reflected on the return filed.

The IRS does not have my direct deposit information. What can I do?

In the coming weeks, Treasury plans to develop a web-based portal for individuals to provide their banking information to the IRS online, so that individuals can receive payments immediately as opposed to checks in the mail.

I am not typically required to file a tax return. Can I still receive my payment?

Yes. People who typically do not file a tax return will need to file a simple tax return to receive an economic impact payment. Low-income taxpayers, senior citizens, Social Security recipients, some veterans and individuals with disabilities who are otherwise not required to file a tax return will not owe tax.

How can I file the tax return needed to receive my economic impact payment?

IRS.gov/coronavirus will soon provide information instructing people in these groups on how to file a 2019 tax return with simple, but necessary, information including their filing status, number of dependents and direct deposit bank account information.

I have not filed my tax return for 2018 or 2019. Can I still receive an economic impact payment?

Yes. The IRS urges anyone with a tax filing obligation who has not yet filed a tax return for 2018 or 2019 to file as soon as they can to receive an economic impact payment. Taxpayers should include direct deposit banking information on the return.

I need to file a tax return. How long are the economic impact payments available?

For those concerned about visiting a tax professional or local community organization in person to get help with a tax return, these economic impact payments will be available throughout the rest of 2020.

Where can I get more information?

The IRS will post all key information on IRS.gov/coronavirus as soon as it becomes available.

The IRS has a reduced staff in many of its offices but remains committed to helping eligible individuals receive their payments expeditiously. Check for updated information on IRS.gov/coronavirus rather than calling IRS assistors who are helping process 2019 returns.

Please feel free to contact Tax On Wheels, LLC at 803 732-4288 if we can assist you with securing your economic stimulus payment.

February 27, 2019

WASHINGTON ― The Internal Revenue Service today reiterated its warning that taxpayers may not be able to renew a current passport or obtain a new passport if they owe federal taxes. To avoid delays in travel plans, taxpayers need to take prompt action to resolve their tax issues.

In January of last year, the IRS began implementing new procedures affecting individuals with “seriously delinquent tax debts.” These new procedures implement provisions of the Fixing America’s Surface Transportation (FAST) Act. The law requires the IRS to notify the State Department of taxpayers the IRS has certified as owing a seriously delinquent tax debt, which is $52,000 or more. The law also requires State to deny their passport application or renewal. If a taxpayer currently has a valid passport, the State Department may revoke the passport or limit ability to travel outside the United States.

When the IRS certifies a taxpayer to the State Department as owing a seriously delinquent tax debt, they receive a Notice CP508C from the IRS. The notice explains what steps a taxpayer needs to take to resolve the debt. Please note, the IRS doesn’t send copies of the notice to powers of attorney. IRS telephone assistors can help taxpayers resolve the debt, for example, they can help taxpayers set up a payment plan or make them aware of other payment alternatives. Taxpayers shouldn’t delay because some resolutions take longer than others, such as adjusting a prior tax assessment.

When a taxpayer no longer has a seriously delinquent tax debt, because they paid it in full or made another payment arrangement, the IRS will reverse the taxpayer’s certification within thirty days. State will then remove the certification from the taxpayer’s record, so their passport won’t be at risk under this program. The IRS can expedite the decertification notice to the State Department for a taxpayer who resolves their debt, has a pending passport application and has imminent travel plans or lives abroad with an urgent need for a passport.

A taxpayer with a seriously delinquent tax debt is generally someone who owes the IRS more than $52,000 in back taxes, penalties and interest for which the IRS has filed a Notice of Federal Tax Lien and the period to challenge it has expired or the IRS has issued a levy.

Before denying a passport renewal or new passport application, the State Department will hold the taxpayer’s application for 90 days to allow them to:

- Resolve any erroneous certification issues,

- Make full payment of the tax debt, or

- Enter a satisfactory payment arrangement with the IRS.

Ways to Resolve Tax Issues

There are several ways taxpayers can avoid having the IRS notify the State Department of their seriously delinquent tax debt. They include the following:

- Paying the tax debt in full,

- Paying the tax debt timely under an approved installment agreement,

- Paying the tax debt timely under an accepted offer in compromise,

- Paying the tax debt timely under the terms of a settlement agreement with the Department of Justice,

- Having requested or have a pending collection due process appeal with a levy, or

- Having collection suspended because a taxpayer has made an innocent spouse election or requested innocent spouse relief.

Relief programs for unpaid taxes

Frequently, taxpayers qualify for one of several relief programs including the following:

- Payment agreement. Taxpayers can ask for a payment plan with the IRS by filing Form 9465. Taxpayers can download this form from IRS.gov and mail it along with a tax return, bill or notice. Some taxpayers can use the online payment agreement to set up a monthly payment agreement.

- Offer in compromise. Some taxpayers may qualify for an offer in compromise, an agreement between a taxpayer and the IRS that settles the tax liability for less than the full amount owed. The IRS looks at the taxpayer’s income and assets to decide the taxpayer’s ability to pay. Taxpayers can use the Offer in Compromise Pre-Qualifier tool to help them decide whether they’re eligible for an offer in compromise.

Subject to change, the IRS also will not certify a taxpayer as owing a seriously delinquent tax debt or will reverse the certification for a taxpayer:

- Who is in bankruptcy,

- Who is deceased,

- Who is identified by the IRS as a victim of tax-related identity theft,

- Whose account the IRS has determined is currently not collectible due to hardship,

- Who is located within a federally declared disaster area,

- Who has a request pending with the IRS for an installment agreement,

- Who has a pending offer in compromise with the IRS, or

- Who has an IRS accepted adjustment that will satisfy the debt in full.

For taxpayers serving in a combat zone who owe a seriously delinquent tax debt, the IRS postpones notifying the State Department of the delinquency and the taxpayer’s passport is not subject to denial during the time of service in a combat zone.

For more on these procedures and the law visit IRS.gov. The IRS first announced this matter in IRS news release IR-2018-7 on Jan. 16, 2018.

If you need help resolving an IRS tax debt issue, give us a call at 803 732-4288 to see how we can help.